IT IS EASY TO LOSE MONEY IN S-REITS

- by Gabriel Yap

- Jan 1, 2022

- 5 min read

Updated: Jan 9, 2022

1/1/2022

2021 marked the 20th Year of S-REITs in Singapore. Contrary to many media exhortations and bankers marketing, it is actually EASY to lose money in S-REITs – the statistics is almost 50%! Rather, it has been DIFFICULT making money in S-REITs in the past 20 years.

Let’s delve into what the last 20 years of data points tell us for S-REITs. As we have always taught in GCP Global (we enter 2022 as our 33rd Year in Financial Education and loving every minute of it), the empirical data is always the BEST evidence of how profitable (or not) it is to invest in S-REITs.

There is almost a 50% chance of LOSING money in S-REITs

Table 1 shows 18 out of 38 S-REITs (excluding Daiwa House Log and Digital Core Reit which only listed in 2021) either registered negative Compounded Annual Growth Rate, CAGR or are trading below their respective IPO prices at end-2021. This is a very HIGH 48% occurrence!

Table 1 - 18 out of 38 S-REITs either registered negative Compounded Annual Growth Rate, CAGR or are trading below their respective IPO prices at end-2021

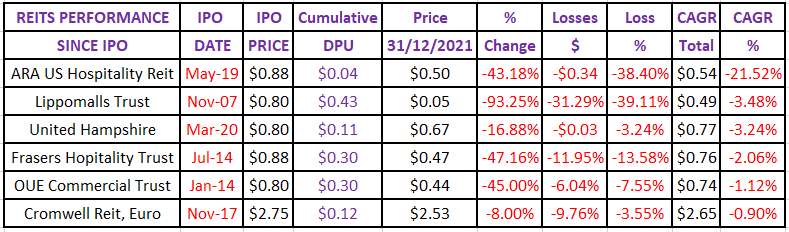

Having the WRONG REITs can DESTROY your investment portfolio

Table 2 shows that out of these 18 S-REITs, 6 posted negative CAGR since their IPO. The longest listed REIT is Lippomalls which IPO in November 2007. Despite its long debut on SGX in the last 14 years, Lippomalls registed a horrendous lost of 93% of its capital value compared to its IPO price of $0.80! Even including cumulative DPU of 43.31 cents of the past 14 years, an investor of Lippomalls would still have lost 31.29 cents or 39% based on the closing price of $0.054 at end-2021. This a NEGATIVE CAGR of 3.5%!

Table 3 shows the Worst-Performing S-REITs in terms of Capital Loss from their respective IPO prices. It is notable that 8 REITs or 21% of S-REITs have registered capital losses above 30% as at end-2021. This is HORRENDOUS CAPITAL DESTRUCTION!

Table 3 - 8 REITs or 21% of S-REITs have registered capital losses above 30% as at end-2021. This is HORRENDOUS CAPITAL DESTRUCTION!

S-REITs have provided investors with long term sustainable total returns

With the listings of Daiwa House Logistics Trust and Digital Core REIT in 2020, the number of S-REITs have grown to 40. As listed in detail in Table 4, 6 out of the 38 REITs or ONLY 16% had delivered compounded average growth returns (CAGR) of more than 10% to the REIT investor. This means that you would have doubled your investment capital every 8.5 years if you had invested in these seven REITs since their respective Initial Public Offer (IPO).

The Top 6-REITs, delivered CAGR of between 10.2% - 18.1% return or an average of 14.1%. This means that if you had the ability and skills to pick the Top-6 Performing REITs (I am a shareholder of all the Top 6 REITs) since their IPO, you would have been able to double your investment capital approximately every five-and-the-half years – that’s the power of dividend compounding and the ability to pick out the winners in REITs.

Table 4 - 6 out of the 38 REITs or ONLY 16% had delivered compounded average growth returns (CAGR) of more than 10%

Using Keppel DC REIT as an illustration, despite a negative capital return of % in the just concluded 2021 year after a 35.1% return in 2020 and 54.1% return in 2019, 1 million units of Keppel DC REIT costing a total of $930,000 at IPO would have yield you total dividends of $505,500 in the past seven years till end-2021. The same 1 million units of Keppel DC REIT bought at $930,000 is worth $2.47million at end-2021. Thus, the total gain is $2.045,500! And as long as you remain as its shareholder, you will continue to reap dividends every half-yearly. Top performer Keppel DC REIT’s CAGR worked out to an annual gain of 18.1% for the past seven years. You will continue to double your initial investment capital and every dollar invested in Keppel DC REIT every 4.5 years approximately IF this trend continues.

WHAT 2021 HAS SHOWN THE SAGACIOUS REIT INVESTOR

The first rule of making money and growing your wealth is “DO NOT LOSE YOUR CAPITAL”. The second rule is “DO NOT FORGET RULE ONE”.

It is clear from the historical performances of S-REIT that avoiding losses and side-stepping Bad Apples is KEY in making money and growing your wealth. It takes a lot of hard work and continuous watchful eyes to catch the turning points in S-REITs, brought about by either deterioration in business fundamentals or absurd acquisition decisions by Sponsors or Managers.

Join us for our upcoming Quarterly REITs class entitled “Buying & Positioning into the Best REITS for 2022” on 12 Feb 2022 and enjoy the EARLY-BIRD SPECIAL PRICE before 15Jan 2022! Click the image below of this link https://gcpglobalsg.wixsite.com/gcpglobal/events-1/buying-positioning-into-the-best-reits-for-2022

Or our Tech Class on 19 March 2022 - Investing Profitably In The FAAMG & Doubling Your Money In Tech Stocks

https://gcpglobalsg.wixsite.com/gcpglobal/events-1/buying-positioning-into-the-best-reits-for-2022

In the new year 2022, we aspire to continue do this well for our GCP Global investors who are mainly hedge funds, index funds, REIT funds, Family Offices and UHNIs which now total more than 8,000 internationally.

2021 has continued to exemplify what we have been teaching all last 32 years –

LESSON LEARNED

1. It takes a lot of hard work and continuous watchful eyes to catch the turning points in S-REITs, brought about by either deterioration in business fundamentals or absurd acquisition decisions by Sponsors or Managers 2. Nonetheless, S-REITs have provided investors with long term sustainable total returns if you know how to pick the Winners 3. But to be able to achieve that, it is imperative for the investor to be able to pick the right REITs for your portfolio to achieve consistent and steady returns over the years and decades. 4. Side-stepping bad apples is part and parcel of REIT investing. The Smart and Sharp REIT investor needs to understand perspicuously when to ditch these apples before they turn bad or to recognize conditions that will make these apples turn back subsequently.

OUR LATEST MEDIA INTERVIEW ON REITS, TECHNOLOGY & DISRUPTOR INNOVATORS –

1. FIGHT HOTS UP FOR LOGISTICS ASSETS – 24 Nov 2021, BUSINESS TIMES INTERVIEW

2. NON-SEQUITUR FOR S-REITS IN THE EPRA INDEX? 17 Sep 2021, BUSINESS TIMES INTERVIEW

https://www.facebook.com/gabrielyap17/?eid=ARBIaPqFh8i6100SM69EUaP0PqWBjSnJsc-tq2v6kM3EsF3JzWthv7yWi6hl4-T6NfqC8N5wEYejP3k6

3. CHINA REITS COULD GIVE S-REITS SOME COMPETITION – 21 Jun 2021, BUSINESS TIMES INTERVIEW

4. IMPACT OF CHINA REITs ON S-REITs – 14 Jun 2021, LianHe Zaobao

5. WISDOM EYE ON BUSINESS – 25 May 2021, Wisma Geylang Serai, South East Community Development Council of Singapore

6. BOTTOM FISH FOR TECH & CHINA TECH – 25 Apr 2021, BUSINESS TECH ASIA

7. HOW DO INVESTORS SPOT REIT MERGERS THAT DESTROY VALUE? – 19 Apr 2021, PRIME TIME MONEY FM89.3

8. MAINLAND INVESTORS FLOCK TO S-REITS – 26 Apr 2021, LIAN HE ZAOBAO

REITS FOR A GOOD CAUSE

GCP Global students donate to help Covid-19 victims

OUR PARTNERSHIP WITH MONEY FM89.3 IN ITS MAIDEN LAUNCH OF MONEY MATTERS https://www.facebook.com/352565835119256/posts/1126789454363553/

OUR LATEST PUBLICATIONS -

1. LESSONS LEARNED FROM INVESTING IN GOOGLE IN THE PAST 10 YEARS

2. THE ABILITY TO DELIVER DPU GROWTH IS THE KEY IN S-REITS SUPERIOR PERFORMANCE IN 2021

3. SEVEN & HALF YEARS ITCH IN S-REITS – THE ITCH CONTINUES WITH SEVERE RAMIFICATIONS

4. SEPERATING THE SHEEP FROM THE GOAT IN S-REITS

https://gcpglobalsg.wixsite.com/gcpglobal/post/separating-the-sheep-from-the-goat-in-s-reits

5. WHERE & HOW to make your next Million in the Year of the Ox

Comments