The Good, The Bad and The Ugly in S-REITs – Avoiding Value Traps with ROIC

- by Gabriel Yap

- Oct 4, 2021

- 6 min read

10/2021

The history of REITs and markets is, and always will be, the story of things that were unprecedented until they happened. That’s hard to accept unless you have been through it yourself. In our 32 years’ experience, we have certainly experienced the Good, the Bad and the Ugly, as the vintage song goes.

Pessimism in S-REITs and Business Trust can be intellectually seductive in a way optimism can only wish it could be. Tell an investor that REITS will be going up as the impact of its latest acquisition will become apparent in the next quarter and you are likely to get a shrug or rolling eyeballs. Tell REIT investors that their investments are in danger of a big fall and you have their undivided attention. This is how we save millions from losses in S-REITs and Business Trust. This is what we do at GCP Global and I guess we must have continued to do it well as we continue to see steady consistent demand for our REITs classes on a quarterly basis for the past 32 years.

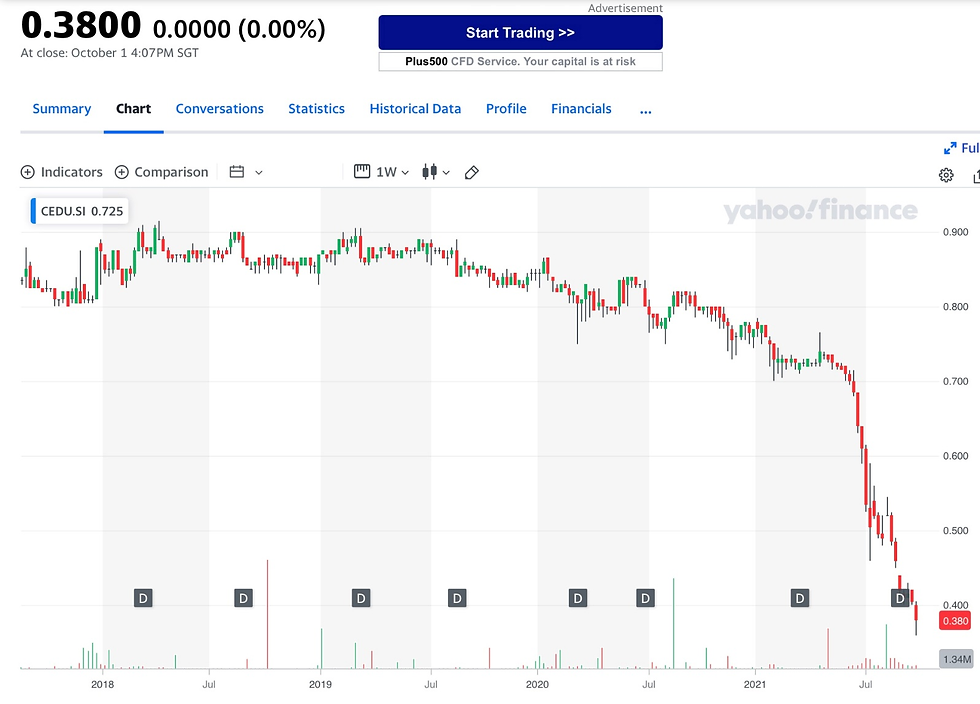

Let me illustrate with what we have taught on Dasin Retail Trust through these years.

Dasin listed on the SGX in Jan 2017 at an IPO price of $0.80. While many analysts, websites and media touted Dasin as a BUY because of its mouth-watering 9% dividend yield and discount to its NAV, we smelled fishiness and warned our student investors (we have more than 8,000 student investors globally comprising of hedge funds, family offices and UHNIs) to stay away from Dasin as our key measure of value – Return on Invested Capital, ROIC pointed us to the fishiness.

As Warren Buffet has indicated “the primary test of managerial economic performance is the achievement of a high earnings rate on equity capital employed”.

At GCP Global, we have always taught that the ROIC forms one of the triumvirate of factors that help an investor gauge the strength of a company’s economic moat. ROIC is a measure of value creation.

We always try to isolate the annual performance of a business or REIT as it is the best way to know if management has been able to accomplish its task of generating a return on operations of the business given the capital employed. GCP Global, like Warren Buffet, views this as the best judge of management’s economic performance, more so when REITs and business trusts are in the business of buying and selling assets.

Let’s look at Dasin in detail.

2017

Dasin ended its first-year of listing in 2017 with the following numbers -

It’s unbelievable, but is true – Dasin only registered an ROIC of 2.55%! It does not matter how attractive management or bankers of the IPO tell investors of their assets - it will show up in the ROIC. And in Dasin’s case, many may respond with alacrity “Da!!! …it almost a sin that it is so low?”

2018

Despite a full-year contribution from newly -acquired Shiqi Metro Mall in 2017, Dasin’s NPI for 2018 already missed its IPO forecast due to lower actual NPI from its initial IPO portfolio assets.

In our public seminar for Maybank Kim Eng clients held at the SGX Auditorium, we had shared that –

1. Dasin’s already low ROIC set a new record low of 1.9% for 2018. Clearly, with interest rates rising to 5.0% in China in 2018, investors were probably better off with fixed deposits in the bank rather than pay for such a high equity risk premium.

2. Dasin’s disclosure of its plan to inject its pipeline of 20 ROFR properties from its sponsor sent shivers down my spine when its current track record of ultra-low ROIC is already so abysmal.

2019

Both LT and ST loans shot up further due to the acquisition of Doumen Mall. However, incremental income did not measure up which sent the already low ROIC down a new low of 1.65%.

2020

Dasin acquired Shunde Metro Mall and Tanbei Metro Mall in July 2020. It raised $94 million via a private placement of $0.78 per share on 26 Jun 2020. In our REIT classes and 2-hour long live interview on Money Matters with host Ms Michelle Martin, we had strongly urged viewers to avoid Dasin Retail Trust as its ROIC hit a new low of 1.31%. It certainly reminds investors of the limbo rock chant – “How Low can it go?”

Dasin ended 1 Oct 2021 at $0.38.

It clearly shows and exemplifies that –

1. For the uninitiated investor, you would have lost 52.5% from its IPO price of $0.80. This means that for a $1 million invested at IPO, you would have lost a woeful $525,000 all these years!

2. For the supposedly smart money investor who took the private placement, you would have also lost 51.3% from the private placement price of $0.78, certainly nothing preferential in this. This means that for a $1 million invested in Dasin at the private placement just last year, you would have lost an unbelievable $512,821 in less than 1.5 year! As the private placement raised $94 million, this would mean that $48 million has been lost on Dasin in less than 16 months!

3. Historical data and trend are mostly the study of unprecedented events, which most analysts and forecasters ironically, have used as a map of the future, let alone a valuation parameter. Actually, what I find to be the most valuable aspect of historical data and trend is in the study of how investors behaved when something unprecedented happened. It is the most consistent of behavior that will help shape future valuations and trends. However, most times, Sell or valuation reports only state statistical data. What most investors want is the interpretation of such data to make informed and accurate investment decisions.

4. Making Money is one of the strongest forces in the world of investments. They cause ordinary people to do great things and vice versa especially when their money and wealth are on the line. Speak to investment analysts or forecasters who do not bet their wealth on REITS and speak to the investors (at GCP Global, we have trained more than 8,000 investors from all walks of life) who put their hard-earned money in REITS for steady returns and the differences can be as stark as day light and counterintuitive.

To this end, we at GCP Global will continue to hold the hands of REIT investors to avoid Value Traps as NOT losing money is even a greater way of making money in S-REITs. Do take advantage of the Early-Bird Special price and join us for our next REIT class on 13 Nov 2021 as we share with you our proven 32-year ratiocination process of wringing out winners and side-stepping losers in S-REITs. In addition, we will share with you

As usual, we hope you had enjoyed another great monthly article from us.

SIGN UP for our next Quarterly REITS class on 13 Nov 2021 at -

GCP GLOBAL RECOGNISED AS ASIA’S FOREMOST EDUCATOR IN REITS IN THE SINGAPORE CORPORATE AWARDS 2019

https://www.facebook.com/gabrielyap17/videos/740467253053012/

OUR LATEST MEDIA INTERVIEW ON REITS, TECHNOLOGY & DISRUPTOR INNOVATORS IN 2Q2021 –

1. NON-SEQUITUR FOR S-REITS IN THE EPRA INDEX? 17 Sep 2021, BUSINESS TIMES INTERVIEW

https://www.facebook.com/gabrielyap17/?eid=ARBIaPqFh8i6100SM69EUaP0PqWBjSnJsc-tq2v6kM3EsF3JzWthv7yWi6hl4-T6NfqC8N5wEYejP3k6

2. China REITs could give S-REITs some competition – 21 Jun 2021, Business Times

3. IMPACT OF CHINA REITs on S-REITs – 14 Jun 2021, LianHe Zaobao

4. WISDOM EYE ON BUSINESS – 25 May 2021, Wisma Geylang Serai, South East Community Development Council of Singapore

5. How to Make Millions in REITs – 30 Apr 2021, FM96.3 HAO in Mandarin

6. Bottom Fishing for Tech & China Tech – 25 Apr 2021, BUSINESS TECH ASIA

https://youtu.be/QVqUfI2Bsxw

7. How do investors spot REIT mergers that destroy value? – 19 Apr 2021, PRIME TIME MONEY FM89.3

https://www.moneyfm893.sg/guest/gabriel-yap-gcp-global/?fbclid=IwAR0_qCcYb3fEpyCjQ-8zbPxHOSP9FxUaXWWHR-k8KGIDL-zCZleW8kfWCm8

8. Mainland Investors flock to S-REITs – 26 Apr 2021, LIAN HE ZAOBAO

https://www.facebook.com/gabrielyap17/photos/pcb.1315235015518995/1315233215519175/

9. Most S-REIT mergers have destroyed shareholder value? – 16 Apr 2021, BUSINESS TIMES

10.Opportunities to Accumulate Tech and China Internet Stocks – 11 Apr 2021, BUSINESS TECH ASIA

11. How to Make Millions in REITs – 30 Apr 2021, FM96.3 HAO in Mandarin

12. Bottom Fishing for Tech & China Tech – 25 Apr 2021, BUSINESS TECH ASIA

https://youtu.be/QVqUfI2Bsxw

13. How do investors spot REIT mergers that destroy value? – 19 Apr 2021, PRIME TIME MONEY FM89.3

https://www.moneyfm893.sg/guest/gabriel-yap-gcp-global/?fbclid=IwAR0_qCcYb3fEpyCjQ-8zbPxHOSP9FxUaXWWHR-k8KGIDL-zCZleW8kfWCm8

14.Mainland Investors flock to S-REITs – 26 Apr 2021, LIAN HE ZAOBAO

https://www.facebook.com/gabrielyap17/photos/pcb.1315235015518995/1315233215519175/

15. Most S-REIT mergers have destroyed shareholder value? – 16 Apr 2021, BUSINESS TIMES

REITS FOR A GOOD CAUSE

GCP Global students donate to help Covid-19 victims

OUR PARTNERSHIP WITH MONEY FM89.3 IN ITS MAIDEN LAUNCH OF MONEY MATTERS https://www.facebook.com/352565835119256/posts/1126789454363553/

OUR LATEST PUBLICATIONS -

1. WHAT KINDA REIT ACQUISITIONS WILL DRIVE SHARE PRICES

2. SEVEN & HALF YEARS ITCH IN S-REITS – THE ITCH CONTINUES WITH SEVERE RAMIFICATIONS

3. SEPARATING THE SHEEP FROM THE GOAT IN S-REITS

https://gcpglobalsg.wixsite.com/gcpglobal/post/separating-the-sheep-from-the-goat-in-s-reits

4. WHERE & HOW to make your next Million in the Year of the Ox

5. 7th Year Itch for S-REITs and its severe ramifications for the REIT investor

https://gcpglobalsg.wixsite.com/gcpglobal/post/7th-seven-year-itch-for-s-reits-its-severe-ramifications

6. Tripling Your Money with Global Tech stocks

Comments